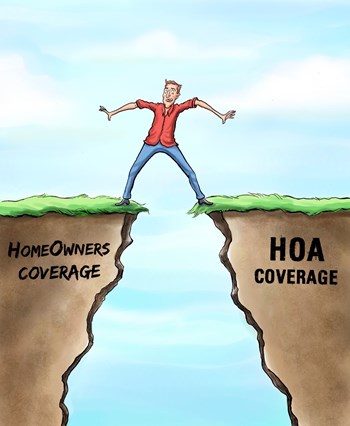

Insurance is designed to be there for us when we need it most. Without knowing the full extent of our coverage, though, we may find ourselves with less protection than we thought. For condominium owners, it is imperative to understand exactly what liabilities and risks are covered by individual resident homeowner policies and what is covered by the building’s policy. Knowing exactly what is protected and by whose policies is imperative in ensuring that properties and possessions are in good hands should an emergency arise.

“Many unit owners don't understand the limitations of the association's insurance and thereby think that they don't need to obtain their own insurance,” says Matthew Zifrony, director at Tripp Scott Attorneys at Law in Fort Lauderdale. “They mistakenly believe that their unit is fully covered by the association's insurance. Others don't understand how Florida Statutes actually obligate them to obtain and maintain hazard insurance that covers the portions of their unit that aren't covered by the association's policy. Others don't understand how the association's liability insurance—i.e., insurance that covers harm to person when they're in the unit—likely doesn't provide any protection against liability claims that arise in a particular unit.”

Attorney Rachel Frydman of The Frydman Law Group in Plantation agrees. “Many owners believe the association’s insurance policy will cover damage to their personal property in the event of a casualty or will cover damage to a neighbor’s property due to a leak in their unit,” she says. This is not the case. “Owners will become personally responsible for damage sustained by a neighbor should his or her toilet or bathtub leak downstairs, or should his or her water heater explode. Having insurance will cover the damage as long as the owners are not deemed negligent in the maintenance of these items.”

Know Your Insurance

In order to avoid problems later, it is important for unit owners to learn as much as they can about their own policy, their building’s policies and where any gaps may exist. In general, says Zifrony, “a condo association's hazard insurance policy covers all portions of the unit except personal property,” such as floor, wall and ceiling coverings, electrical fixtures, appliances, water heaters and water filters, built-in cabinets and counter tops, and window treatments. The individual policy is designed to cover everything that the condo association's policy does not.

Jon Moller, who is with the insurance firm Brown & Brown of Florida, Inc., in Fort Lauderdale, adds that the easiest way to understand what the unit owner must cover versus what the building covers is that “the unit owners’ insurance covers everything in the unit from the ‘paint in.’ The association is responsible for everything else including the drywall and common areas.”

For example, should a hurricane cause damage, Moller says, “essentially both the unit owner and association will have financial obligations. There will be a large hurricane deductible that must be met. If a unit owner has an HO-6 policy, it will pay at least $2,000 of assessments that they are responsible for to the association to meet the deductible.”

In most cooperatives and condominiums, “the insurance obtained by such entity is to cover the damage sustained to the actual building itself and all common elements and common areas,” says Frydman. “The money paid out by such a policy in the event of a fire or hurricane, for example, will depend on the amount of coverage under the policy and will hopefully be enough to bring the building up to code. It will not cover the owners’ personal property such as couches, clothes, electronics, et cetera.”

Understanding the ins and outs of these policies will avoid surprises later. “Every board or manager or both should educate their unit owners on their responsibility as a unit owner when it comes to insurance,” says Moller. “The only problem is most boards and property managers are confused or uneducated when it comes to insurance themselves.” Moller’s firm holds “unit owner responsibility meetings, as well as hurricane preparedness meetings. In these meetings we go over the importance of the unit owner having their own insurance policy for their unit and what type of claims could happen that the associations will not cover.”

It also may help to consult an attorney when making the initial condominium purchase to ensure a firm understanding of all obligations including insurance. “I believe that it is crucial that any person buying in a condominium or cooperative obtain counsel to go over the obligations associated with purchasing in such a building so that they can be advised to pay the maintenance to avoid foreclosure, obtain contents or property insurance, and maintain your appliances, pipes and electrical panels,” she says. “This advice is priceless.”

It is the responsibility of the unit owner to do their own investigating when it comes to personal versus building coverage. “I don't believe that the board or the manager has a legal responsibility to educate residents about insurance,” says Zifrony. “With that being said, I think that it's always helpful to have an education process so that the residents understand the limitations of the insurance that the association is providing them.”

Moller adds, “An association is required to have their policy book on the premises; therefore they have all the information on the property. The only problem is insurance can be confusing and if you are not a licensed insurance agent, you should not be trying to explain coverages. You may tell someone they are covered for something when they are not. When they have a claim and it is not covered, they will be looking to you for payment.”

With that in mind, he suggests that managers and board members as well as unit owners consult on a regular basis with their agents and turn to agents who are willing and able to educate their clients. “Some agents will just send their bill each and every year, and never explain coverages after their initial presentation,” says Moller. “We always offer meetings, as often as they like, to educate the unit owners, board, and manager on each of their responsibilities as it comes to insurance. As we see in these meetings, the majority of the unit owners have no idea what they are responsible for and how important an HO-6 policy is.”

Frydman agrees. “It is not anyone’s legal responsibility to educate their residents about getting proper insurance. However, I always counsel my clients that it is important to inform all new owners and continually discuss this with current owners—that insurance can be a life saver in a casualty or leak damage. I always suggest bringing in the association’s insurance agent to a board meeting and going over what is covered by the association’s policy and what is not. This direct information really shines a light on what the individual owners need to do to be properly covered.”

Ensuring the Proper Coverage

For associations, the goal is to have not only their own insurance responsibilities in order but to encourage unit owners to have their individual policies in order as well. It is difficult for boards and management to determine that, however.

“Unfortunately, the law currently does not give the association’s boards and management the right to force owners to obtain and provide copies of these individual owner policies,” says Frydman. “However, I always recommend that my boards make a yearly request for copies in the event there is an emergency and insurance companies need to be notified in the absence of the owners.”

In years past, Florida statutes allowed associations to secure insurance on behalf of unit owners, the cost of which would be assumed by the unit owners if they refused to purchase it on their own. “The right to ‘force place’ insurance was recently taken out of Florida statutes,” says Zifrony. “Doing so likely eliminated the board's right to force a unit owner into disclosing its insurance status. Associations would likely be able to overcome the foregoing by obligating the unit owners to make this disclosure as part of the association's documents.”

For associations, having unit owners with proper insurance coverage in addition to the building’s own coverage can add up to a healthy risk profile for the entity as a whole. Financially, for example, it could have something of an impact. “I’m not sure if a lender looks more favorably if the building has better insurance and/or a higher percentage of well-insured residents,” says Zifrony. “I think that the opposite is true, however, in that a lender will look unfavorably at a building that is not well insured or a building that has residents that are not meeting their insurance obligations.”

Adds Frydman, “As for the coverage held by the association, it is definitely beneficial to carry insurance that has full replacement value in the event of a catastrophic storm such as Hurricane Andrew or Wilma so that lenders can be assured that the mortgagor will not be hit with a large special assessment that may put the mortgagee at risk for foreclosure should the mortgagor not be able to pay the special assessment.”

When it comes to the things that matter to us most, insurance is imperative in protecting not only our homes and our possessions but our peace of mind. Knowing what is and is not covered and what we can do to make sure all bases are covered is absolutely key in being prepared for the rainiest of days.

Liz Lent is a freelance writer and a frequent contributor to The South Florida Cooperator.

Leave a Comment